Use of Cookies - Cookies help us evaluate interaction with our website. By using our platform, you agree to our use of cookies. More

Since you opened this page,

this is how much tax is unpaid in Europe:

000,000,000,000,000 €

German companies are among the world’s leading tax avoiders

Tax Justice! Ireland's Role in the International Context

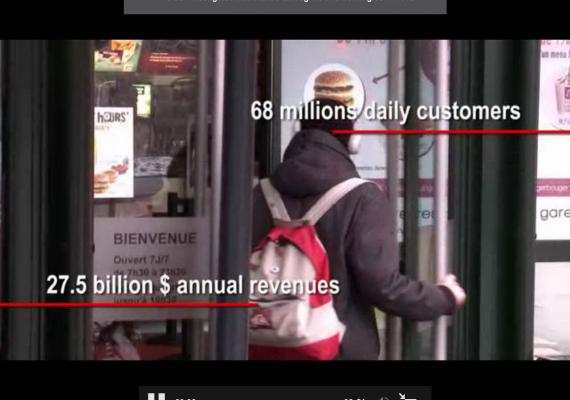

UnHappyMeal: €1bn Tax Avoidance on the Menu at McDonald’s

The impact of austerity on tax collection: one year later and still going backwards

War on Want and EPSU Training on Tax Justice

About our Campaign

In 2012, EPSU, the European Federation of Public Service Unions, launched a campaign to close the tax gap in Europe estimated at € 1000 bn per year (Study by UK expert Richard Murphy for the S&D), as part of the alternatives to EU-coordinated austerity. EPSU believes that it is essential to tackle tax evasion and corporate tax avoidance and ensure that governments are able to collect the levels of the tax that have been democratically agreed to finance public services and redistribute wealth and income.

The campaign flows from the EPSU tax justice charter (adopted by the EPSU Executive Committee, 2010) alongside its demands for the introduction of a Financial Transactions Tax, a common strategy to increase tax on capital and EU common principles on fair and progressive taxation and the eradication of tax havens.

As well as highlighting extent of tax evasion and avoidance and calling for policy change, the purpose of the campaign from a public service union angle is to expose how the resources available to close the tax gap have been eroded through austerity measures. Through the commissioning of two pieces of research to the LRD, EPSU has shown that employment in tax offices has been cut in 24 out of 28 states in the past four years with the loss of more than 56,000 jobs and more cuts to come.

What's New

German companies are among the world’s leading tax avoiders

The Fresenius case: Health company avoids taxes just like Amazon and Google

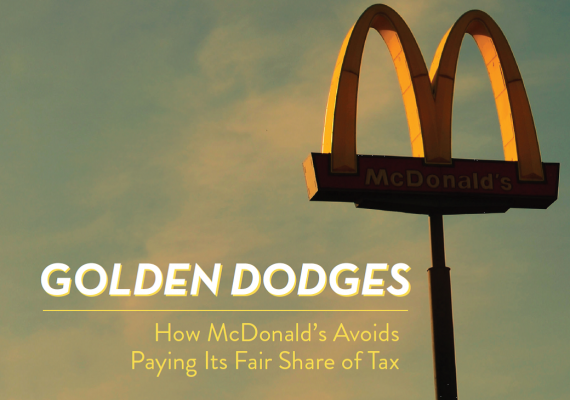

Another bad day for McDonald’s, a good day for tax justice

Federal prosecutor in Brazil launches a criminal investigation into multinational's tax affairs, whilst European Parliament confirms the company will appear again in from of special tax committee.

Are you a tax super sleuth? Take the online quiz!

Are you a Tax Justice super sleuth or a Tax Justice novice? Take this online quiz to find out and share the result with your friends.....

Sign the Petition! Demand Tax Transparency

Public country-by-country reporting (CBCR) would make multinationals publish information showing where they make their money and if they are paying their taxes. Support accountability in corporate taxation.

WATCH The EU investigates McDonald's tax regime and working conditions

McDonald's workers visited the European Parliament this month to talk to MEPs about the companies tax arrangements and working conditions. Watch the video from the Socialists and Democrats group.

McDonald’s is not just a tax dodger, but a bad employer: workers come to Brussels to demand action!

A bad week for McDonald's, as three petitions denouncing their working conditions are submitted to the European Parliament and Italian consumer associations launch antitrust complaint.

Will 2016 be the turning point for corporate tax avoidance?

With €1 trillion lost every year to tax dodgers, will 2016 finally be the year when big business and the wealthy are made to pay their fair share?

Tax Justice in Europe and Sub-Saharan Africa - Project Resources

Videos, leaflets, reports and much more produced as part of the Building Awareness of Tax Justice in Europe and Sub-Saharan Africa Project.

The Net Closes in on Tax Dodgers but There’s No Room for Complacency

European Parliament report is a big step forward, but the pressure must be maintained to get concrete measures to stop tax dodging.

Luxleaks : one year after, pressure is building up for corporate tax transparency

Piketty and MEPs join trade union leaders in writing to EU governments to demand public country-by-country reporting, whilst civil society makes voice heard in support of tax whistleblowers.

Building awareness of tax justice in Europe and Sub-Saharan Africa Report of Final Project Meeting

The final networking meeting of the EC-funded project by War on Want in cooperation with EPSU and affiliates from Sweden, the UK, Spain, Austria and Ireland took place in Brussels on 9 October. Over 30 participants from 8 countries shared their experiences of raising awareness of tax justice.

Update: Two weeks in the fight against the tax dodgers

From pressure on Commission President Juncker to blacklisting of uncooperative companies, the last couple of weeks have confirmed that the fight against tax avoidance is firmly at top of the political agenda.

Finance Ministers’ appearance before tax committee: who said what

The Special Committee on tax rulings and other similar measures (TAXE) met on 22nd September 2015 and had a first exchange of views with Pierre Gramenga, the Finance Minister of Luxembourg, on behalf of the Council, as LU holds the rotating presidency of the EU, and then with the Finance Ministers of Italy, France, Spain and Germany.

EPSU brings McDonald’s tax evasion menu in the French parliament

Last Friday, the European Federation of Public Services Unions presented McDonald’s tax avoidance scheme and EPSU's tax justice priorities at the Assemblée Nationale

EPSU supports Lima Declaration on Tax Justice and Human Rights

Tax revenue is the most important, reliable and sustainable instrument to resource human rights says a statement of an international coalition of tax justice groups including several with whom PSI and EPSU have collaborated

Commission's action plan on corporate taxation lacks clear actions

EPSU and ETUC joint press release

News bulletin #1

Tax justice campaign update: News from the front

Golden Dodges: McDonald’s $1.8 billion global tax avoidance strategy revealed

A new report Golden Dodges: How McDonald’s Avoids Paying its Fair Share of Tax, reveals that McDonald’s is using aggressive strategies to avoid paying tax in some of its largest markets.

Useful Links

Contact Us

Send a Direct Message

Give Us a Call

- European Federation of Public Service Unions Rue Joseph II, 40 - Box 5 1000 Brusselsl

- 32 2 250 10 80 tel 32 2 250 10 99 fax

- Taxjustice@epsu.org